Trading in foreign exchange is an exciting affair. Navigating the market and dealing with the volatility that comes with it has a certain air of thrill to it that can hardly be experienced in any other field. It can be a very exhilarating activity, but for all the high rewards that people can rake in, there are many, many ways for things to go off-kilter.

Given how volatile the Forex market is, traders need to be aware of a few dozen ways things can go wrong. If you go look on Google, you will find tons of these factors. If you are getting into Forex trading or are considering it and going through one of these lists while wondering, “Hmm, what is slippage in trading?” then this is the article for you!

What Does Slippage Mean?

Imagine this. You have just been handed a list of things to buy from the supermarket. Most of the things you already have experience buying, but there is one item you have never bought before. You have no idea how much it costs, so you make an estimate about how much it is worth and go shopping.

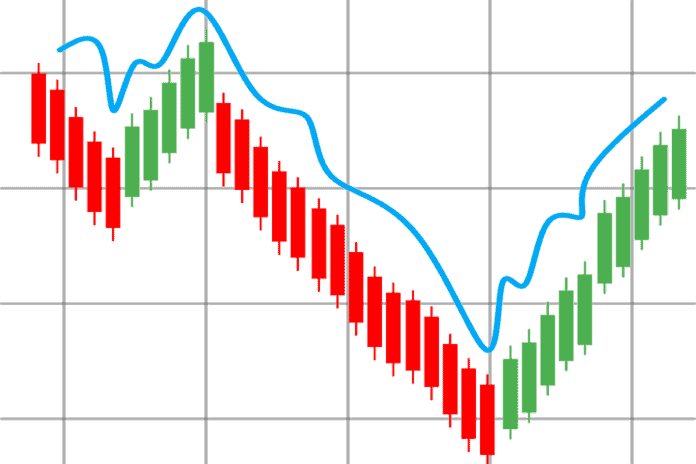

With us so far? Good. Slippage refers to the difference between the amount you thought the item would be and what it actually costs. Not every Forex trade goes the way we expect or at the price at which we expect. When the market is being especially volatile, or when you make an order that is so large that there are not enough units at the chosen price.

How Does Slippage Work, Exactly?

In this section, we will take a closer look at what happens when under the hood. So, when you place an order, and it gets executed, the goods are bought or sold at the most favorable price available to the exchange. As you can imagine, this can lead to a difference between what you expected and what you actually got.

There is a significant time gap between when you place our order and when it actually gets executed – enough time for the market price to change on a very volatile day. Keep in mind though, that this change can be either positive, neutral, or negative. You might end up getting more bang for your buck, or you might end up losing a bit. You will never know what is going to happen.

To stop yourself from getting negative slippage, you might want to consider a limit order. A limit order allows you to set a limit on the maximum or minimum price you want to trade at. However, if you set a limit, the deal trade you were going for might not happen if the price does not go back to the limit you set. This becomes a problem in really volatile markets. If it fluctuates too much, the window for closing a trade gets reduced significantly.

How Is Slippage Related To The Forex Market?

When it comes to Forex trading, a stop loss can make positions close at a different rate than the one you had in mind. Market orders can also do the same thing, so that is one more thing you need to be on the lookout for. Other than this, markets where volatility is high are prime targets for slippage, as we have seen before.

Another cause for slippage is often overlooked but important nonetheless. When the currency pair you are working with gets traded beyond peak market hours, slippage is liable to occur. These are all things you need to keep in mind if you want to become a shrewd and effective Forex market dealer.

Avoiding Slippage: Tips And Tricks

Now that we know what slippage is and how it works, let us look at a few ways in which we can attempt to avoid slippage.

Don’t Trade During High Volatility Hours

Volatility and fluctuation come on the heels of major news and economic events like clockwork. Knowing this, you should not trade when important events like when the national budget is released. This will cause changes and fluctuations as everyone logs in to make the first trade based on incomplete information. Be smart about it, study the news, then make your trade.

Stay Away from Low Liquidity Markets

Stick to markets that have a lot going on. It might seem like a good idea to trade in markets that are not very popular and have not many traders, but it is not worth it. Stick to the tried and tested currency pairs like USD/EUR or USD/GBP. Because they have more activity, they are more readily available, and the probability of slippage is lower.

Liquidity is also dependent on when you do your trading. If you are trading in AUD or JPY, you should do it during the Australian and Asian market hours instead of American.

Conclusion

With everything said and done, the main lesson to take away is that there are always things to remain vigilant of in the Forex trading scene. To become a seasoned trader, you need to stay on top of a lot of things, and our main hope is that this article helped you get used to at least one such annoyance.

Good luck, and happy trading!

![Top 20 Largest World Economies by GDP [Updated 2020] world economy](https://www.moneytaskforce.com/wp-content/uploads/2020/05/world-economy-100x70.jpg)